As the digital asset marketplace expands and increasingly resonates with the mainstream, understanding the tech underpinning this industry – blockchain protocols – becomes indispensable for investors and traders. These protocols are the bedrock of cryptocurrencies like Bitcoin and Ethereum, offering a secure, decentralized framework for transactions. This piece will delve into blockchain protocols and their role in crypto trading, and assess how they’re altering the financial industry’s trajectory.

Demystifying Blockchain Protocols

Blockchain: An Overview

Blockchain, a decentralized and distributed ledger technology, facilitates secure, transparent, and tamper-resistant transaction records. It operates as a chain of blocks, each documenting a set of transactions, maintained by a network of computers – the nodes [1].

[1] “Blockchain: A Technical Primer,” Journal of Financial Transformation

The ABCs of Protocols

Blockchain protocols define the rules and procedures for storing, verifying, and sharing data within a blockchain network. These protocols safeguard the blockchain’s security, consensus, and immutability, ensuring its efficient operation.

The Function of Blockchain Protocols in Crypto Trading

Guaranteeing Security and Trust

A primary function of blockchain protocols in crypto trading is upholding the network’s security and trust. Protocols such as Bitcoin’s Proof of Work (PoW) and Ethereum’s Proof of Stake (PoS) utilize consensus algorithms to achieve this, ensuring all network participants concur with the blockchain’s content.

Streamlining Transactions

Designed for facilitating efficient and seamless transfer of digital assets among users, blockchain protocols provide a transparent, verifiable transaction record accessible to all network participants. This transparency empowers traders and investors to track their assets’ movement and make informed decisions.

Enabling Interoperability

With the proliferation of blockchain networks and digital assets, interoperability is becoming increasingly critical. Protocols like Polkadot and Cosmos are engineered to enable cross-chain communication, allowing seamless asset and information transfer across different networks.

Driving Decentralized Finance

Blockchain protocols are integral to the evolution of decentralized finance (DeFi) – a burgeoning sector offering a transparent, accessible alternative to conventional financial services. Protocols like Ethereum and Binance Smart Chain are central to DeFi’s growth, providing the infrastructure for decentralized applications (dApps) and smart contracts that let users trade, lend, and borrow digital assets sans intermediaries.

Influential Blockchain Protocols in the Crypto Trading Space

Bitcoin (BTC)

Bitcoin, the inaugural and most recognized cryptocurrency, employs the Proof of Work (PoW) consensus algorithm. PoW ensures miners compete to solve intricate mathematical problems, rewarding them with newly minted Bitcoin. This protocol is pivotal in establishing Bitcoin network’s security and decentralization.

Ethereum (ETH)

Ethereum, a blockchain platform supporting smart contracts and dApps, currently uses the PoW consensus algorithm like Bitcoin. However, it is transitioning to Ethereum 2.0, which will employ the Proof of Stake (PoS) algorithm to enhance scalability and energy efficiency.

Binance Smart Chain (BSC)

Binance Smart Chain, a platform designed for executing smart contract-based applications, uses a Proof of Staked Authority (PoSA) consensus algorithm. PoSA merges aspects of PoS and delegated Proof of Authority (PoA) to enhance transaction throughput while maintaining decentralization.

Polkadot (DOT)

Polkadot, a multi-chain protocol enabling interoperability among different blockchain networks, utilizes a consensus algorithm called Nominated Proof of Stake (NPoS). This allows users to nominate validators to secure the network and partake in consensus on their behalf. Polkadot’s unique approach to consensus and interoperability has made it a key player in the crypto trading ecosystem.

Prospective Developments in Blockchain Protocols and Crypto Trading

Scalability and Efficiency

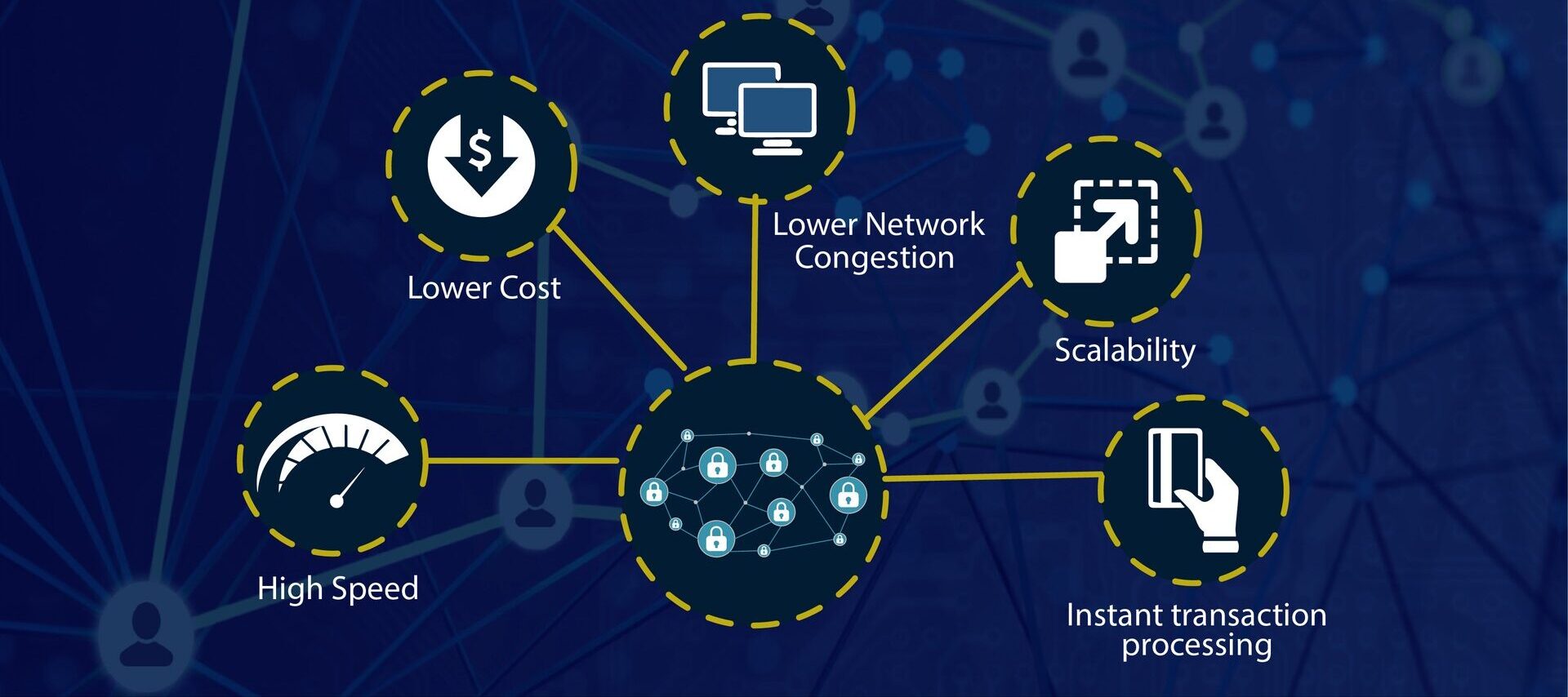

With surging demand for crypto trading, blockchain protocols must enhance their scalability and efficiency. Initiatives such as Ethereum 2.0 and Layer-2 solutions like the Lightning Network are progressing towards addressing these challenges, promising to elevate user experience and foster broader cryptocurrency adoption.

Regulatory Compliance

Blockchain protocols must navigate the ever-changing regulatory environment to ensure the sustained growth and stability of the crypto market. This may require integrating privacy features, such as zero-knowledge proofs, to comply with data protection regulations, or crafting protocols that can engage with traditional financial systems in a compliant way.

Decentralized Identity and Privacy

With rising concerns over data privacy and digital identity, blockchain protocols will increasingly be tasked with offering secure, decentralized solutions. Protocols like SelfKey and Sovrin are already pioneering a new paradigm for managing digital identities, which could significantly impact the future of crypto trading and the broader financial ecosystem.

Conclusion

Blockchain protocols form the engine powering the thriving crypto trading market, providing the crucial infrastructure for secure, transparent, and efficient transactions. As the industry evolves, these protocols will continue to play a critical role in shaping the financial landscape of the future.

From bolstering security and trust to enabling seamless transactions and promoting cross-chain interoperability, blockchain protocols have proven their mettle in the crypto trading space. Given the rise of decentralized finance and the mounting demand for scalable, efficient, and compliant solutions, understanding the role of blockchain protocols in crypto trading is of paramount importance.

Looking forward, it’s evident that blockchain technology will continue to transform the financial industry. By staying abreast of the latest developments in blockchain protocols and understanding their implications for crypto trading, investors and traders can make more informed decisions and contribute to the growth of this groundbreaking technology.